Tips for First-Time Homebuyers to Avoid Mortgage Debt

Buying a home for your family can seem like a really complicated and stressful process, especially if you need to get a mortgage loan to help pay for it. You don't want to get in over your head with a loan you can't really afford.

Before taking out a mortgage, you need to understand your overall financial picture - things like how much debt you already have compared to your income and your credit score. Picking the wrong mortgage could put you at risk of ending up with way too much debt.

This article will explain what mortgage loans actually are and walk you through the steps to buying a home without digging yourself into a debt hole. We'll make sure you know how to get a mortgage that makes sense for your situation.

What Are Mortgage Loans?

A mortgage loan is a way to borrow money from a bank or lender to buy a home or land. It's kind of like a long-term loan, but the property itself is used as collateral. That means if you can't make the payments, the lender can take your home. With a mortgage, you make monthly payments to the lender until the full amount is paid off over an agreed time period, like 15 or 30 years.

Picking a Mortgage - What to Consider

When looking for a mortgage, you'll get offers from different lenders. It's important to compare things like:

- The total amount you need to borrow (the loan size)

- The interest rate they'll charge (average was 7.54% for a 30-year in late 2024)

- How long you'll have to make payments (the loan term - e.g. 15 or 30 years)

- The overall cost including fees (look at the APR to compare total costs)

- If the interest rate is fixed for the whole loan or can be adjusted over time

- Any risky features like prepayment penalties

You'll also need to know what types of mortgages you may qualify for;

Here are the options:

- Conventional loans, which follow the lending standards of FHFA, Freddie Mac, and Fannie Mae

- VA (United States Department of Veterans Affairs) loans

- FHA (Federal Housing Administration) loans

- USDA (United States Department of Agriculture) loans

The lender will look at your credit score, income, debts, and how much you can put down to decide what mortgage options you qualify for. Generally, higher credit scores and down payments will get you better rates.

They will check factors like:

- Credit score: Your credit score will help mortgage lenders offer suitable rates and loan terms. (The average credit score for purchase loan borrowers was 733 as of November 2023)

- Your finances: You have to provide your financial information, like available assets, income, and existing debts to mortgage lenders.

- Credit history: Lenders may review your credit history to check if you are a reliable borrower and manage payments on time.

- Down payment: The amount of down payment you put down against the total property cost can determine your loan eligibility and the applicable mortgage rate.

So do your homework - shop around, compare all the costs and features, and make sure you really understand the type of mortgage you're signing up for.

Are Mortgage Loans Good or Bad Debt?

When you take out a mortgage, you're borrowing money that you have to pay back to the lender over time. While making those monthly payments, the home is essentially collateral - if you stop paying, the lender can take back your house.

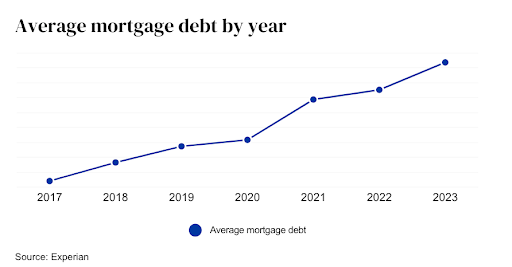

So yes, having a mortgage does mean you are in debt. The total household debt grew to $17.69 trillion by the first quarter of 2024. Within it, the total mortgage debt in the U.S. accounts for $12.44 trillion. For first-time buyers especially, those big numbers can seem scary.

However, most experts consider mortgage debt as "good debt" for a few key reasons:

- It builds equity and wealth as you pay down the loan and your home gains value over the years.

- The interest paid can provide tax benefits.

- Real estate tends to increase in value over the long term, unlike a car loan.

So while any debt brings risks if you can't make the payments, mortgages are seen as much lower risk than things like credit cards, personal loans, or auto loans. The home acts as collateral and the debt is building your net worth.

The key is being very cautious about only taking on a mortgage payment you can truly afford. Do your homework, get pre-approved, and aim for affordable monthly costs. If managed responsibly, a mortgage can be a good, wealth-building form of debt.

Tips for Debt-Free Home Buying Process With Mortgages

There are certain pitfalls that first-time buyers often run into when dealing with mortgages. Here are some top tips to stay out of debt trouble:

Keep Your Credit in Good Shape

Mortgage lenders put a huge emphasis on your credit history and score when deciding what loan offers you qualify for. If you have a track record of making payments on time with little to no outstanding debt, you'll likely get the best mortgage rates and terms.

However, if your credit report shows things like unpaid credit card balances, debt in collections, etc. - that's a red flag and could lead to outright denial or much costlier loan options.

So before applying, take a close look at your credit reports from the three major bureaus (Experian, Equifax, and TransUnion). Dispute any errors you find that could be unfairly dragging down your scores. Cleaning up your credit first can save you thousands on your mortgage.

Check out the government-backed home loans

As a new homebuyer, there are special government-backed mortgage programs that can make it easier and more affordable to get a loan, even if your income is limited or your credit isn't perfect.

Some options to explore:

- VA Loans: If you're a military veteran, active duty service member, or surviving spouse, you may qualify for a VA loan. These allow no down payment, have competitive rates, and don't require mortgage insurance.

- FHA Loans: Backed by the Federal Housing Administration, FHA mortgages only require a 3.5% down payment. They also have looser credit requirements compared to conventional loans, making them a great option for those with lower credit scores.

- USDA Loans: For homes in designated rural areas, the U.S. Department of Agriculture offers loans with no down payment required. Income limits apply, but the rates are low if you qualify.

These government-backed mortgage programs tend to have way more flexibility on down payments, credit scores, and other requirements versus traditional bank loans. They allow many first-timers who may not qualify elsewhere to make their homeownership dream a reality.

The "costs" like mortgage insurance are often lower too. So be sure to look into which of these you may be eligible for based on your personal situation and location.

Get Prepared Well In Advance

The mortgage application process can be pretty complex, so it's really important to prepare carefully ahead of time. Gather up all your key financial documents like:

- Bank statements

- Tax returns

- W-2s from your job(s)

- Your credit reports

You'll also want to make sure you have enough savings built up for a decent down payment on the home. The more you can put down front, the better. Experts recommend aiming for 20% of the home's price if possible.

Rick Berres, owner of Honey-Doers, suggests taking steps like "downsizing to one car instead of two, renting out spare rooms, or cutting streaming services" to free up extra cash for your down payment fund.

Having all your paperwork and finances lined up in advance can save you a ton of stress during the actual mortgage process. The better prepared you are with documentation and money saved, the smoother your homebuying experience will go.

Consider Bi-Weekly Mortgage Payments

Instead of making one monthly mortgage payment, you can ask your lender about setting up a bi-weekly payment schedule. With bi-weekly, you split the monthly amount in half and pay that every two weeks.

So how does this help? Essentially by making 26 half-payments per year, you end up making the equivalent of 13 monthly payments annually instead of just 12.

For example, let's say your normal monthly payment would be $1,432 for a $300,000 mortgage at 4% interest. By paying $716 every two weeks, you'll pay $18,616 that year - equal to 13 of those $1,432 payments.

That extra payment per year can save you a lot over the full mortgage term. In this scenario, you could pay off the mortgage 4 years early and save around $23,000 in interest!

Not all lenders allow bi-weekly payments or some may charge extra fees for it. But if your lender offers it for free, it's definitely worth considering as an option to pay down your mortgage faster without much extra effort.

Just be sure you'll always have enough cash flow to cover those every-other-week payments. But for salaried workers or those living paycheck to paycheck, bi-weekly payments can be an easier way to get ahead.

Pay Extra Towards Your Principal When Possible

If your mortgage balance is over 80% of your home's value, you can make extra payments beyond your normal monthly amount to pay it down faster. Use any extra cash windfalls like tax refunds, bonuses, investment profits, etc.

However, make sure to specify that these additional payments go towards the principal balance, not just being applied to future scheduled payments. In the early years especially, most of your regular monthly payment goes to interest rather than principal.

So putting any extra money directly towards the principal loan amount, rather than just paying ahead on interest, is ideal for really making a dent. The sooner you can pay down that principal, the less total interest will accrue over the full loan term.

Your lender may have a specific process for allocating extra principal payments. Let them know upfront that any extra funds should go to the principal balance pay down. Chipping away at that principal, even in small amounts, can translate to huge interest savings over 15-30 years.

The more proactive you are about making even modest overpayments, the faster you'll pay off that mortgage and the less you'll pay in total mortgage costs. Every little extra bit helps!

Look Into Refinancing for a Lower Interest Rate

As a new homeowner, one way to make your mortgage payments more manageable is to refinance to a lower interest rate if rates drop.

"You may have to consider refinancing your mortgage if market conditions change and lower rates become available," says Loren Howard, founder of Prime Plus Mortgages. Lowering that interest rate can reduce your monthly payments and long-term costs significantly.

For example, let's say you originally got a $300,000 30-year mortgage at 5% interest, making your monthly payment around $1,610. If you're able to refinance a few years later to a 3.5% rate, your new monthly payment would drop to $1,347.

That $263 monthly savings means you'd pay $3,156 less per year. And over the remaining 25-30 years, you could save a whopping $94,680 in total interest costs!

For first-time buyers, refinancing to a lower rate is one of the simpler strategies to understand and can provide huge long-term savings. Just be aware of upfront closing costs and make sure the interest savings outweigh those over your timeframe.

But if the numbers pencil out, refinancing could allow you to much more comfortably afford your mortgage long-term. It's an option well worth exploring periodically.

Shop Around and Compare Multiple Mortgage Offers

Don't just go with the first mortgage loan you come across. It's really important to get quotes from multiple lenders and compare all the key factors:

- Interest rates

- Loan terms (15-year, 30-year, etc.)

- Upfront fees and closing costs

- Down payment requirements

- Qualification criteria like credit score minimums

Lenders can vary a lot in the rates, costs, and mortgage products they offer. By taking the time to shop around and compare at least 3-5 different lenders, you increase your odds of finding the most affordable overall mortgage for your situation.

Maybe one lender has a slightly higher rate but much lower upfront fees. Or perhaps another allows a lower down payment but charges more over time. The only way to find the true "best deal" is to put in the work comparing multiple official mortgage quotes.

It can seem like a hassle, but getting quote details from at least a few different banks, credit unions, and mortgage companies gives you bargaining power. You can use each lender's offer to try to get the others to compete for your business.

So don't settle for the first mortgage you see. Do your homework and go through the full comparison-shopping process. A little extra effort can save you thousands over the mortgage lifespan.

Budget for Ongoing Maintenance and Repair Costs

Beyond your monthly mortgage payment, there are other expenses that come with owning a home. You'll need to set aside money for maintenance, repairs, and replacing things like appliances over time.

A general guideline is to budget 1-4% of your home's value annually for these ongoing costs. So if your home is worth $300,000, you may need $3,000 to $12,000 per year for upkeep.

However, the actual number can vary quite a bit depending on the age and condition of the home you buy:

- Older Homes: If it's an older property, expect to be on the higher end, like 3-4% for renovations, roof repairs, foundation work, etc.

- Newer Homes: With a brand new or relatively new construction, your maintenance costs may only be around 1-2% of the home's value in those first few years.

It's really important to factor these maintenance expenses into your overall homebuying budget from the start. Failing to account for things like a new HVAC system down the road could put you in a financial bind and at risk of falling behind on mortgage payments.

By setting aside a designated home repair fund according to the property's age and conditions, you'll be prepared to handle any necessary upgrades or fixes that pop up over the years. This protects you from unexpected costs draining your finances.

Consider Working with a Financial Professional

If you're feeling overwhelmed by the mortgage process or unsure how to best manage your finances, don't be afraid to seek professional help.

A financial planner or advisor can provide personalized guidance tailored to your specific situation. They'll do a deep dive into your income, debts, credit profile, and goals to create a comprehensive plan for you.

This can include:

- Analyzing your full financial picture objectively.

- Recommending the right mortgage products/terms for your needs.

- Mapping out a strategy to pay down your mortgage efficiently.

- Advising on other money moves to avoid falling into debt.

The mortgage lending process has a lot of complex components. Financial advisors are experts who can cut through the confusion. With their expertise, you can make well-informed decisions and structure your mortgage optimally.

While advisors don't work for free, the money spent can be well worth it to ensure you're on the right track from the beginning. Their professional guidance can potentially save you thousands down the line.

For first-time buyers especially, having an experienced third party look out for your best interests can give valuable peace of mind. You'll know you have a solid plan in place.

Consolidating Other Debts Into Your Mortgage

If you have high-interest debt like credit cards along with your new mortgage, consolidating those debts can potentially save you money and simplify payments.

Debt consolidation rolls multiple debt balances into one new loan, ideally with a lower interest rate. For example, let's say you have $20,000 in credit card debt at 18% interest. By consolidating that into your 4% mortgage, you could drastically reduce the interest costs.

Instead of paying around $300 per month just in interest on those cards, rolling that $20,000 into your low mortgage rate may only add $60-80 to your monthly payment. That could translate into hundreds of dollars in savings month over month.

However, consolidating does have some potential downsides to consider:

- You're extending the repayment timeline on those other debts over the full mortgage term.

- If you can't make mortgage payments, your home itself is now at risk.

So consolidation needs to be carefully evaluated for your specific finances. It can save a ton in interest short-term, but may cost more long-term depending on repayment timelines.

The key is running the numbers, perhaps with a financial professional's assistance. If the interest savings outweigh any long-term costs, consolidation could make managing your overall debts more affordable.

But don't make the decision lightly - make sure you understand all the potential pros and cons first. The right move depends on your full financial picture.

Conclusion

The mortgage process can understandably feel overwhelming, especially for first-time homebuyers dealing with such a large loan. While mortgages are considered a "good" form of debt, it's still important to be proactive about paying them off efficiently.

The key is exploring strategies to minimize the overall interest costs and pay down that principal faster while staying within your budget. An upfront investment of time can potentially save tens of thousands over the life of the loan.

With some research and guidance, you can structure an affordable, manageable mortgage that becomes a wealth-building tool rather than a crippling debt burden. The goal is sustainable homeownership while avoiding financial strain.